We are currently raising capital via our March 2023 Offer of Rights and Ordinary Shares in Punakaiki Fund.

This is a opportunity for all New Zealanders to access the VC asset class and be part of the growth of exciting NZ tech companies, including: Devoli, Quantifi Photonics, Conqa, Whip Around and many more.

Please read the PDS and invest through Catalist.

Offer closes 28 March 2023.

We are currently raising capital via our March 2023 Offer of Rights and Ordinary Shares in Punakaiki Fund.

Please read the PDS and invest through Catalist.

Punakaiki Fund is venture capital for everyone. We want all investors to have access to the New Zealand tech ecosystem, to benefit from our the growth of our diverse portfolio, and to be part of the journey of compelling homegrown companies like Devoli, Quantifi Photonics, Whip Around, Orah, and many more.

We want to provide all investors with access to the potential high-returns of venture capital and New Zealand’s innovative tech ecosystem.

We want to continue helping visionary founders to grow disruptive, world-class companies, for longer.

We want to continue leading the transition from a volume to value economy.

Punakaiki Fund is a venture capital investment company with total assets of $96 million as at the end of September 2022 and is managed by 2040 Ventures Limited.

We’re raising funds to make further long-term investments into high- growth, revenue-generating New Zealand-based technology companies.

Punakaiki Fund has investments in technology companies, including: Devoli, Quantifi Photonics, Whip Around, Couchdrop, Orah, RedSeed, and CONQA, along with 10 other Portfolio Companies.

Punakaiki Fund sold its investments in Vend, Timely and Moxion in 2021, and has realised total proceeds to date from those exits of $19.9 million, with another estimated $0.9 million yet to be received.

In FY2022, Punakaiki Fund returned a net profit after tax of $15.8 million, driven by increase in fair value of investments, with $1.8 million of negative operating cash flows.

The September 2022 interim accounts showed a net loss after tax of $3.1 million with $1.3 million of negative operating cash flows.

Punakaiki Fund is raising new capital to make further venture capital investments into existing Portfolio Companies and, potentially, new companies, as well as meeting operating costs and setting funds aside for possible IPO-related costs.

Rights holders can exercise their Rights and purchase $19 Shares.

Any New Zealand investor can purchase $31 Shares.

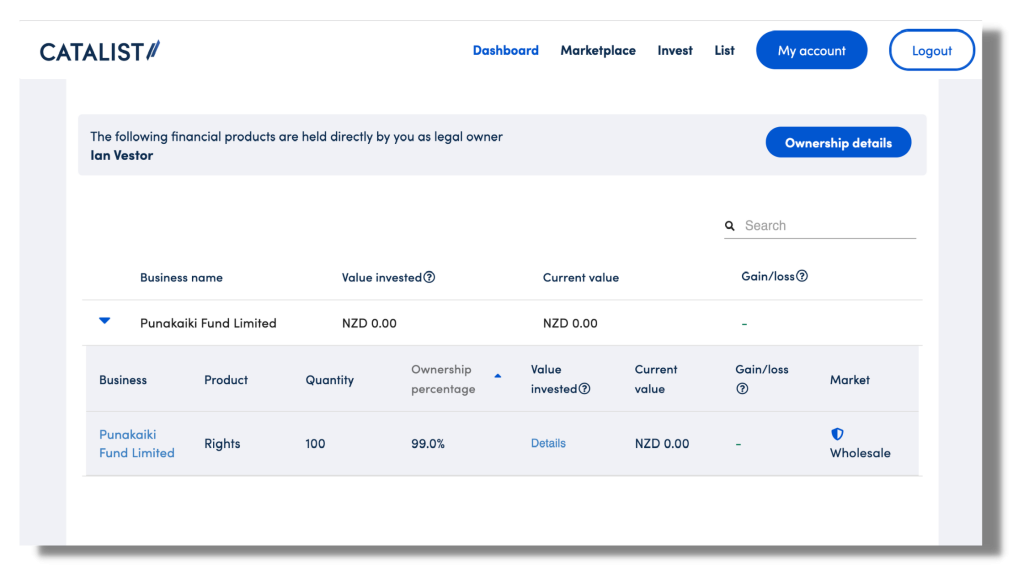

Punakaiki Fund has a periodic Share auction process hosted by Catalist. Trading generally happens after the release of Punakaiki Fund’s quarterly report. Punakaiki Fund’s Share auctions are not part of Catalist’s licensed financial product market (under the Financial Markets Conduct Act 2013), however, we use the same trading systems and benefit from Catalist’s approved electronic transfer system.

Investors trade at their own risk. Certain investor protections do not apply that accompany a licensed stock exchange, such as the Catalist Public Market, NZX or ASX. Such protections relate to insider trading, ongoing disclosure, directors’ and officers’ relevant interest disclosure and substantial security holder disclosure. Punakaiki Fund cannot guarantee that this facility will always be available to Shareholders.

To date, Catalist has facilitated two periodic Share auctions between Shareholders.

Punakaiki Fund does not intend to quote these Shares on a market licensed in New Zealand and there is no other established market for trading them. This means that you may not be able to sell your Shares.

Punakaiki Fund does not offer the ability for Shares to be redeemed.

An investment in Punakaiki Fund should be considered a long-term investment. Returns to investors over the long-term are driven by:

The growth and profitability of our Portfolio Companies and the dividends they pay drives the changes in the value of our Assets per Share. In particular, Devoli represents over 20% of our Assets and its performance is a material driver of returns.

Our strategies and plans

Aside from Portfolio Company performance, valuations are driven by metrics observed from public financial markets, events including investment rounds, and “exits” (when companies are sold or listed on a stock exchange).

Our strategies and plans

Shares that have been traded between existing Shareholders tend to do so at a discount to the underlying value per Share.

Our strategies and plans

The operation of Punakaiki Fund generates costs, which may be offset by dividends received from Portfolio Companies.

Our strategies and plans

Investments in Shares are risky. You should consider if the degree of uncertainty about Punakaiki Fund’s future performance and returns is suitable for you. The price of these Shares should reflect the potential returns and the particular risks of these Shares. Punakaiki Fund considers that the most significant risk factors that could affect the value of the Shares are:

Venture capital investments are designed to be high return, and have an associated high risk of failure. Punakaiki Fund mitigates this risk by investing only in businesses with sufficient revenue and in accordance with the diversification strategy outlined in our Statement of Investment Policies and Objectives, while also regularly marking down Portfolio Companies that do not perform to expectations.

Our investments in Devoli, Quantifi Photonics, Orah, RedSeed and CONQA represent over 65% of the value of Punakaiki Fund’s total investments as at September 2022 and material changes in their performance and valuation would affect the value of the Shares. We have a policy of diversifying investments, we monitor and value these large investments carefully, and (via 2040 Ventures) we have board seats for each of these companies and assist where we can add value. We expect concentration risk to occur as companies outperform and increase in value.

While we almost always have directorships or observation rights, as well as well-defined shareholder rights, 2040 Ventures and Punakaiki Fund are unable to control the activities of the Portfolio Companies we invest into. These are controlled by the boards of each Portfolio Company, but are also subject to high levels of control by founders and other shareholders. We work in collaboration with founders towards aligned goals, and actively work with founders and other shareholders to generate alignment on strategy and tactics.

This summary does not cover all of the risks of investing in Shares. You should also read Section 8 of this PDS, Risks to Punakaiki Fund’s Business and Plans, on page 48 of the PDS.

Please read the Product Disclosure Statement before you consider investing in Punakaiki Fund.

We also recommend:

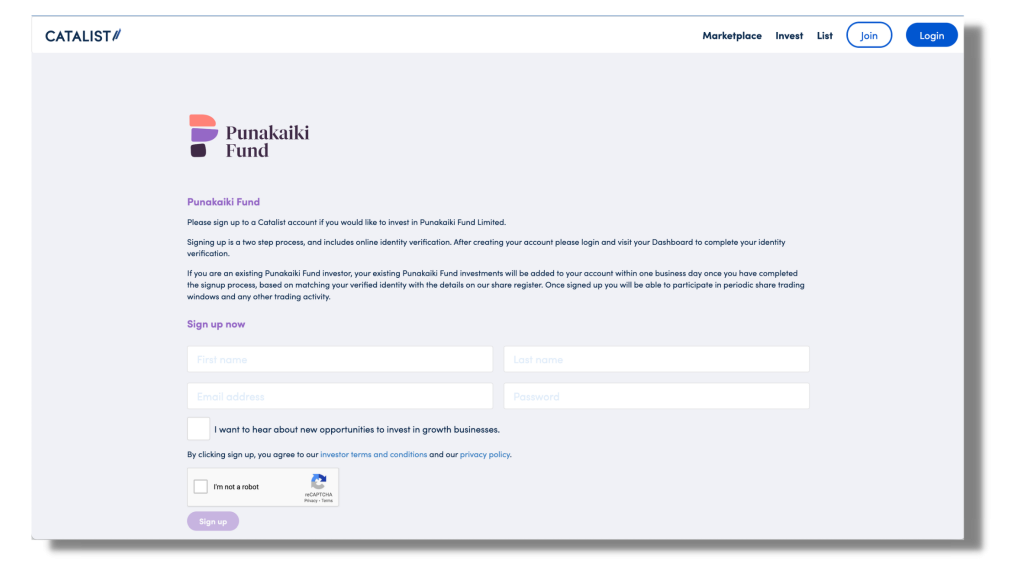

The Rights Issue, Rights Trading and the Offer are all hosted on the Catalist platform (catalist.co.nz). If you’re an existing shareholder, please sign up using the same email address where you receive Punakaiki Fund Shareholder updates. This will help us to connect your current security holdings with your Catalist account. Please contact Catalist if this does not happen within one business day after signing up.

Once you have created an account, login to complete Catalist’s Anti-money Laundering/Countering Financing of Terrorism customer due diligence checks. Once you have completed the AML checks, you will be able to participate in the trading of Rights, subscribing for any Rights you own after the Rights Trading Period, and/or apply for Offer Shares in the Offer.

On 3 March 2023, Punakaiki Fund shareholders were issued with one Right for every 10 Shares held. Each Right gives the holder the opportunity to purchase one $19 Share in Punakaiki Fund.

Rights holders can also choose to sell their Rights, and anyone can bid to buy Rights, during a limited-time Rights trading period on Catalist, between 6-10 March. More on Rights trading below.

After the Rights trading auction completes, Rights holders can exercise their Rights and purchase one $19 Share for every Right they hold. Rights can be exercised between 15-28 March 2023.

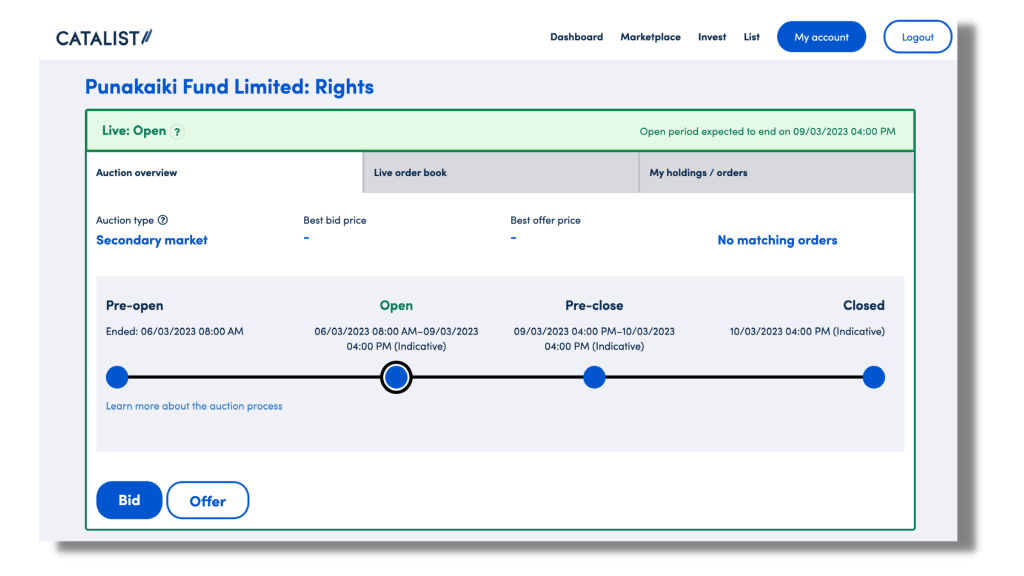

Shareholders who wish to sell, and any investor who wishes to buy, Rights can do so during the Rights Trading Period on Catalist.

Bid or Offer before 4p.m. Thursday 9 March 2023

The Rights Trading Period opens on 6 March 2023 for a four-day “open period”. You can only create bids to buy, and offers to sell, Rights during the open period, which closes 4 p.m. Thursday 9 March 2023.

You can trade Rights from the Catalist Punakaiki Fund Rights Page.

Watch the tutorial videos below showing how to submit a bid to buy, or an offer to sell, Rights.

You must download and read a copy of the PDS from the “Key documents” tab on the righthand side of the Rights page prior to continuing with Rights Trading.

If you are offering to purchase Rights, Catalist will email you the payment details relating to your Application Monies. Payments must be received within 24 hours of you submitting a bid to purchase Rights, regardless of whether that offer to purchase Rights is ultimately successful. This approach is undertaken so that Catalist can settle all Rights Trading in a timely manner and the timetable for the Rights Settlement Period can be maintained.

Your bid to purchase Rights may be cancelled if you don’t pay the amount due within 24 hours.

During the Rights Trading Period, Catalist operates a four day ‘open’ period, where bids and offers for Rights can be placed into the auction order book.

Once the open period has been completed, there is a further 24-hour pre-close period where you can increase your bid price by up to 10% and decrease your offer price by up to 10%, but no new bids or offers will be accepted.

At the end of the pre-close period, a clearing price will be determined to maximise the number of Rights traded and all successful bids (at prices at and/or above the clearing price) and offers (at prices at and/or below the clearing price) will be traded at the clearing price.

The Rights Trading Period closes at 4p.m. on 10 March 2023.

15 March 2023 to 28 March 2023

On or before 15 March 2023, all Rights holders will be sent an email stating the number of Rights they own and be able to log in to their Catalist account to see how many Rights they hold.

Rights holders can exercise their Rights and purchase one $19 Share for every Right held when the Rights Settlement Period opens on 15 March 2023 until when the Rights Settlement Period closes at 11:59pm, on 28 March 2023.

Rights can be exercised from the Catalist Punakaiki Fund Rights Page. You must be logged in to your Catalist account to exercise your Rights.

Watch our tutorial video for how to exercise your Rights or read the step-by-step instructions below.

The top of the Rights page will be highlighted green during the Rights Settlement Period.

Click the ‘Exercise Rights/Options’ button.

You will be prompted to download and read a copy of the PDS, if you have not already done so.

Once you read the PDS, return to the Catalist page in your browser and complete the form.

Enter how many Rights Issue Shares you wish to exercise (up to the maximum number of Rights you hold) and click ‘Exercise’ to submit your Application.

Catalist will send you an email with a verification code. Copy and paste the code into the form to verify your order.

Catalist will then display the payment details relating to the payment of your Application Monies. Follow the instructions to pay for your order, making sure to use the correct bank account, particulars and reference details when making the payment. Catalist will also send you an email with the payment details and confirming your order.

Payments must be received within 24 hours of the Rights Settlement Period closing on 28 March 2023.

Catalist will send you a confirmation email once they have received your payment. This may take 1-2 business days.

6 March 2023 to 28 March 2023

Any New Zealand investor can apply for $31 Offer Shares from 6 March 2023, until when the Offer closes at 11:59pm on 28 March 2023 from the Catalist Punakaiki Fund Offer Page

The top of Offer page will be highlighted green during the Offer and give you access to the Application form for the Offer.

Download and read a copy of the PDS from the “Key documents” tab on the righthand side of this page prior to continuing with your Application.

Enter the number of Offer Shares you wish to subscribe for and click ‘submit’. Catalist will email you a verification code. Copy the code from your email and paste it into the form on Catalist to verify your order.

Follow the payment instructions to pay for your Shares.

You will also receive confirmation of your order and the payment instructions via email.

Payments must be received within 24 hours of the Offer Close date, 28 March 2023.

Catalist has a variety of resources on its website to assist investors with the Catalist Application Process, including:

If you have any questions regarding the Catalist platform or the applications processes, please contact Catalist in the first instance:

020 4009 6929 | hello@catalist.co.nz

If you would like to talk to Punakaiki Fund about the application process or any aspect of the Offer or the Rights Issue, please contact 2040 Ventures:

Angela James

angela@2040ventures.com

027 331 8030

Lance Wiggs

lance@2040ventures.com

021 526 239

Chris Humphreys

chris@2040ventures.com

027 622 7803