We have lodged the Product Disclosure Statement for our 2023 Offer of Rights and Ordinary Shares. The offer launches on 6 March, 2023 and begins with a limited-time auction to acquire Rights to steeply discounted $19 Shares.

This is a unique opportunity for all New Zealanders to access the VC asset class and be part of the growth of exciting NZ tech companies, including: Devoli, Quantifi Photonics, Conqa, Whip Around and many more.

Please read the PDS and seek financial advice before you consider investing.

Please read the Product Disclosure Statement before you consider investing in Punakaiki Fund.

We also recommend:

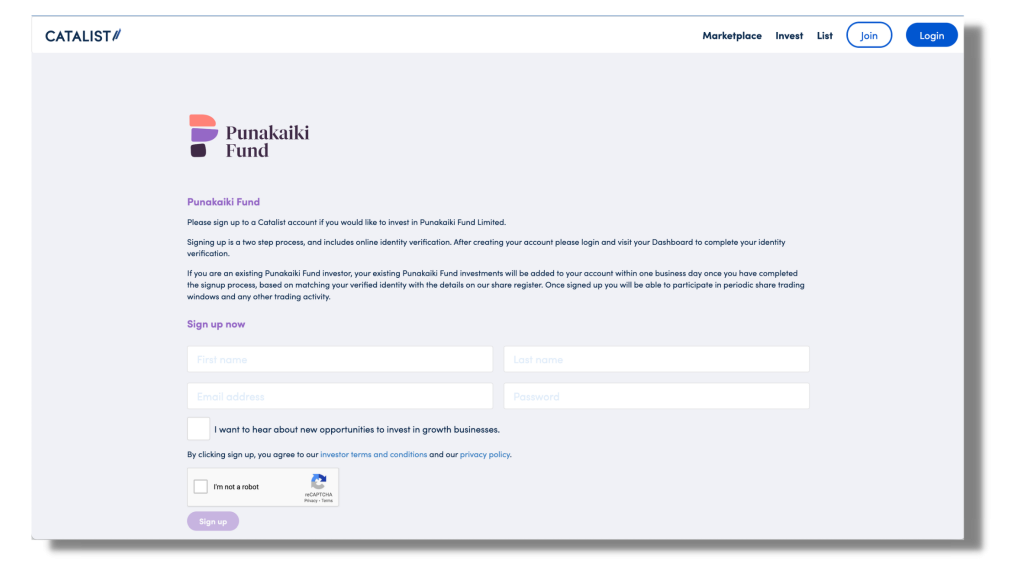

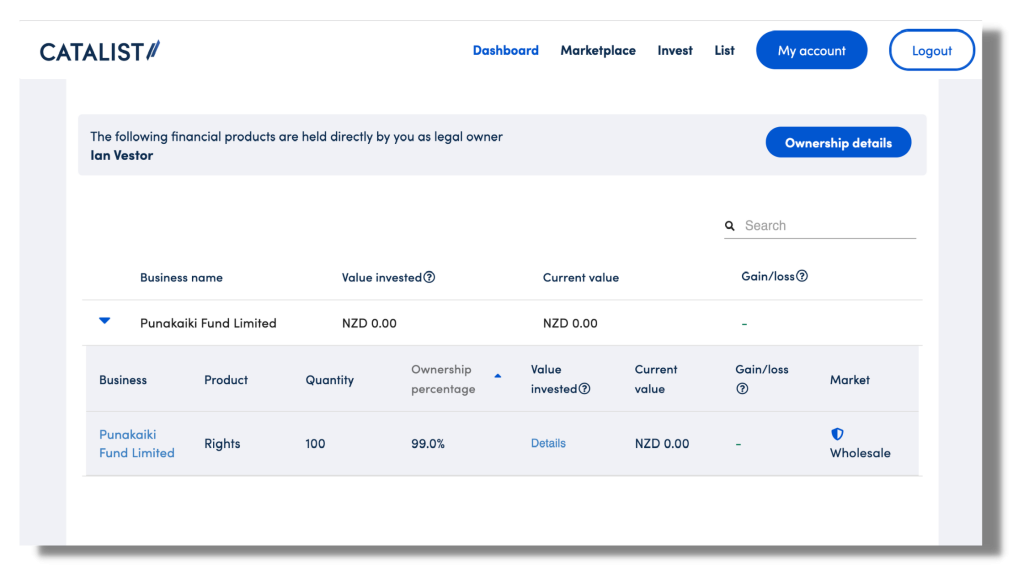

The Rights Issue, Rights Trading and the Offer are all hosted on the Catalist platform (catalist.co.nz). If you’re an existing shareholder, please sign up using the same email address where you receive Punakaiki Fund Shareholder updates. This will help us to connect your current security holdings with your Catalist account. Please contact Catalist if this does not happen within one business day after signing up.

Once you have created an account, login to complete Catalist’s Anti-money Laundering/Countering Financing of Terrorism customer due diligence checks. Once you have completed the AML checks, you will be able to participate in the trading of Rights, subscribing for any Rights you own after the Rights Trading Period, and/or apply for Offer Shares in the Offer.

On 3 March 2023, Punakaiki Fund shareholders were issued with one Right for every 10 Shares held. Each Right gives the holder the opportunity to purchase one $19 Share in Punakaiki Fund.

Rights holders can also choose to sell their Rights, and anyone can bid to buy Rights, during a limited-time Rights trading period on Catalist, between 6-10 March. More on Rights trading below.

After the Rights trading auction completes, Rights holders can exercise their Rights and purchase one $19 Share for every Right they hold. Rights can be exercised between 15-28 March 2023.

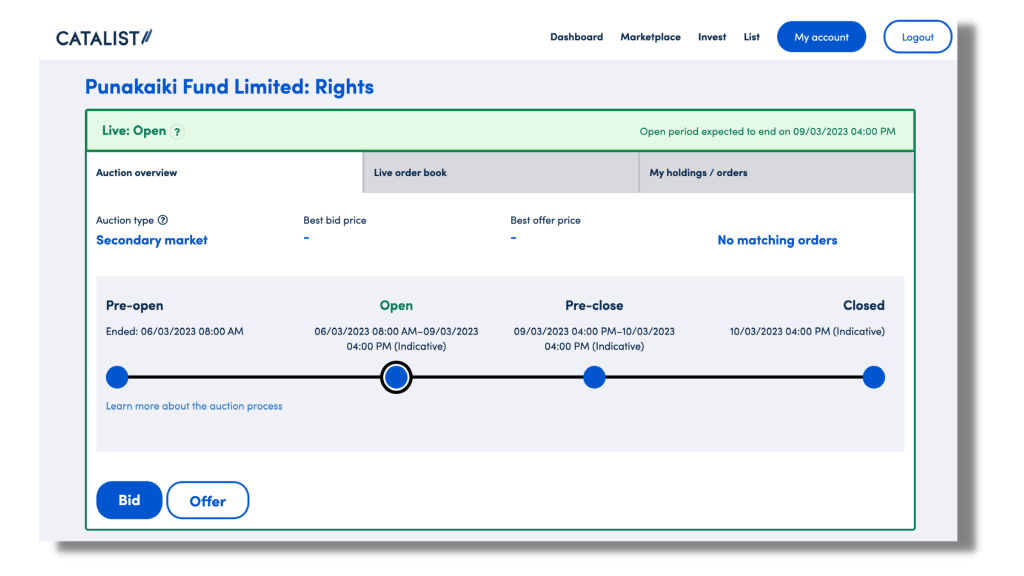

Shareholders who wish to sell, and any investor who wishes to buy, Rights can do so during the Rights Trading Period on Catalist.

Bid or Offer before 4p.m. Thursday 9 March 2023

The Rights Trading Period opens on 6 March 2023 for a four-day “open period”. You can only create bids to buy, and offers to sell, Rights during the open period, which closes 4 p.m. Thursday 9 March 2023.

You can trade Rights from the Catalist Punakaiki Fund Rights Page.

Watch the tutorial videos below showing how to submit a bid to buy, or an offer to sell, Rights.

You must download and read a copy of the PDS from the “Key documents” tab on the righthand side of the Rights page prior to continuing with Rights Trading.

If you are offering to purchase Rights, Catalist will email you the payment details relating to your Application Monies. Payments must be received within 24 hours of you submitting a bid to purchase Rights, regardless of whether that offer to purchase Rights is ultimately successful. This approach is undertaken so that Catalist can settle all Rights Trading in a timely manner and the timetable for the Rights Settlement Period can be maintained.

Your bid to purchase Rights may be cancelled if you don’t pay the amount due within 24 hours.

During the Rights Trading Period, Catalist operates a four day ‘open’ period, where bids and offers for Rights can be placed into the auction order book.

Once the open period has been completed, there is a further 24-hour pre-close period where you can increase your bid price by up to 10% and decrease your offer price by up to 10%, but no new bids or offers will be accepted.

At the end of the pre-close period, a clearing price will be determined to maximise the number of Rights traded and all successful bids (at prices at and/or above the clearing price) and offers (at prices at and/or below the clearing price) will be traded at the clearing price.

The Rights Trading Period closes at 4p.m. on 10 March 2023.

15 March 2023 to 28 March 2023

On or before 15 March 2023, all Rights holders will be sent an email stating the number of Rights they own and be able to log in to their Catalist account to see how many Rights they hold.

Rights holders can exercise their Rights and purchase one $19 Share for every Right held when the Rights Settlement Period opens on 15 March 2023 until when the Rights Settlement Period closes at 11:59pm, on 28 March 2023.

Rights can be exercised from the Catalist Punakaiki Fund Rights Page. You must be logged in to your Catalist account to exercise your Rights.

Watch our tutorial video for how to exercise your Rights or read the step-by-step instructions below.

The top section of the Rights page will be highlighted green during the Rights Settlement Period and give you access to the Rights settlement form.

You must download and read a copy of the PDS from the “Key documents” tab on the righthand side of the Rights page before continuing with your Rights settlement Application.

Once you have downloaded and read the PDS, return to the Catalist page in your browser where you will see the Rights Settlement Form displaying the number of Rights you hold.

Enter how many Rights Issue Shares you wish to exercise (up to the maximum number of Rights that you hold) and click ‘Exercise’ to submit your Application.

Catalist will send an email with a verification code to your inbox. Copy and paste the code into the form to verify your order.

Catalist will then display and email you the payment details relating to the payment of your Application Monies. Follow the instructions to pay for your order, making sure to use the correct bank account, particulars and reference details when making the payment.

Payments must be received within 24 hours of the Rights Settlement Period closing on 28 March 2023.

Catalist will send you a confirmation email once they have received your payment. This may take 1-2 business days.

6 March 2023 to 28 March 2023

Any New Zealand investor can apply for $31 Offer Shares from 6 March 2023, until when the Offer closes at 11:59pm on 28 March 2023 from the Catalist Punakaiki Fund Offer Page

The top of Offer page will be highlighted green during the Offer and give you access to the Application form for the Offer.

You must download and read a copy of the PDS from the “Key documents” tab on the righthand side of this page prior to continuing with your Application.

Enter the number of Offer Shares you wish to subscribe for and click ‘submit’. Catalist will email you a verification code. Copy the code from your email and paste it into the form on Catalist to verify your order.

Follow the payment instructions to pay for your Shares.

You will also receive confirmation of your order and the payment instructions via email.

Payments must be received within 24 hours of the Offer Close date, 28 March 2023.

Catalist has a variety of resources on its website to assist investors with the Catalist Application Process, including:

If you have any questions regarding the Catalist platform or the applications processes, please contact Catalist in the first instance:

020 4009 6929 | hello@catalist.co.nz

If you would like to talk to Punakaiki Fund about the application process or any aspect of the Offer or the Rights Issue, please contact 2040 Ventures:

Angela James

angela@2040ventures.com

027 331 8030

Chris Humphreys

chris@2040ventures.com

027 622 7803

Lance Wiggs

lance@2040ventures.com

021 526 239