Devoli’s Remarkable Growth: The Hidden Telecom Giant Fuelling New Zealand’s Broadband Revolution

We are delighted to report that Devoli’s revenue run rate is now over $100 million per year. This growth is built on a simple yet powerful business model: being the best at helping its customers deliver high-quality broadband at scale.

Devoli’s Unique Approach in the Wholesale Telco Space

Unlike many in the wholesale telecommunications sector, Devoli isn’t competing with its own customers. Instead, they focus on lowering the true cost to serve residences and businesses, enabling rapid expansion for their wholesale customers’ businesses. This customer-centric approach has set them apart and driven significant growth for their partners.

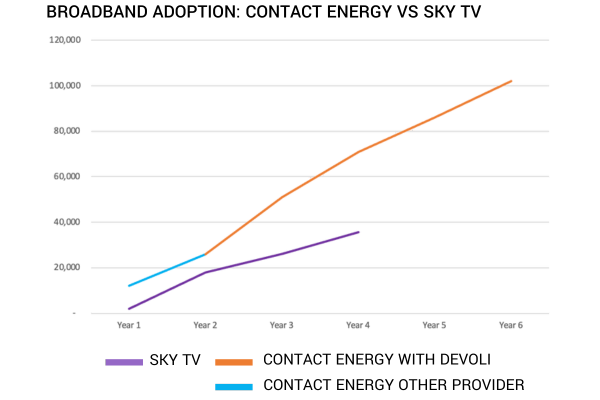

The Devoli Impact: Contact Energy vs. Sky TV

The impact of Devoli’s partnership can be clearly seen when comparing the broadband growth of Contact Energy and Sky TV.

Contact Energy’s Transformation with Devoli

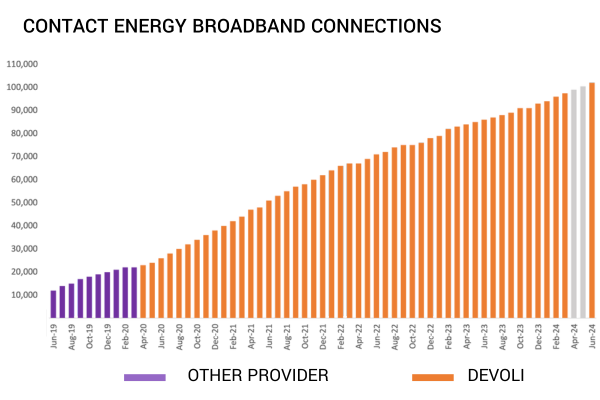

Contact Energy’s decision to switch to Devoli sparked a transformation in their broadband offering:

- Accelerated Growth: While Contact’s growth was initially modest, the growth rate of broadband connections immediately shifted higher after the Devoli partnership began.

- Impressive Numbers: Today, Contact has over 100,000 broadband connections.

- Financial Boost: Telecommunications (now including mobile) contribute more than $82 million in revenue and $10 million in gross margin to Contact’s business.

- Surpassing Gas Margins: The margins generated by Contact’s telecommunications arm recently surpassed that of their residential gas business.

Sky TV’s Missed Opportunity

Sky TV chose another provider and has struggled to ramp up broadband adoption at scale:

- Slower Growth: Finished FY2024 with 36,000 connections, with annual growth seemingly constrained to around 10,000 new connections per year.

- Potential Gains: Had they experienced the same growth rate as Contact Energy did with Devoli, they might have reached 60,000 connections, potentially rising to 76,000 next year.

- Financial Impact: This hypothetical gap represents an additional $21 million in potential annualised revenue, rising to $26 million in the forecast year.

- Reduced Churn: Offering broadband reduced churn of their Sky’s TV Boxes by 12%, highlighting tremendous and lasting economic value.

These numbers clearly show the missed opportunity and should make CFOs and investment analysts take notice.

We are seeing 12% lower churn in those customers who have Sky Broadband with their Sky Box, confirming the value of the bundle.

Sophie Moloney | Sky Chief Executive | 2024 Annual Report

Why Devoli Makes the Difference

While there are plenty of unknown factors at play, we’ve long maintained that Devoli’s independence, size, and laser-focus deliver better results for their enterprise clients and customers:

- Independence: Not competing with their own customers allows for stronger partnerships.

- Cost Efficiency: They enable partners to deliver rapid growth and lower their total cost to serve.

- Competitive Advantage: Providing a real edge in the market for their clients.

The Growth Story Continues

With over 125,000 broadband connections, Devoli is the large New Zealand internet service provider that nobody has heard of. They are happy to operate behind the scenes, remaining focused on providing exceptional service while allowing their clients to take centre stage—a strategy that continues to pay off in high-quality products and superior customer experience.

Punakaiki Fund’s Role in Devoli’s Journey

We are proud to be the only venture fund to invest in Devoli. This exemplifies how Punakaiki Fund has the ability to see potential in companies that others don’t and access deal flow that others can’t.

Our long-term investment approach means that even as Devoli brings in over $100 million in annual revenue, it remains an active part of our portfolio. We uniquely offer a mix of safety through large, later-stage assets that we’ve nurtured and grown over time, as well as a range of early-stage startups with the potential for rapid growth—such as Projectworks, Couchdrop and Whip Around—all of which we are proud to be the only New Zealand venture investor.

Join Us in Supporting New Zealand’s Innovators

We are excited to offer a new investment opportunity:

- Investment Offer: $30 per share, plus a free long-dated option attached to each share purchased (expiring June 2027).

- Eligibility: Open to wholesale investors only.

- Your Impact: Investment gives you access to our existing portfolio—including rising stars like Devoli—as well as powering new investments in innovative New Zealand companies.

Investing with Punakaiki Fund means joining us in supporting the next generation of Kiwi success stories.

Recent News: Strengthening Devoli’s Leadership

We are delighted to announce that John Wiggs, Lance Wiggs’ brother, has joined the Devoli Board of Directors. John is a long-standing shareholder in Devoli, was CEO of Devoli for a time, and is based in Australia where he is Sales Director for a large SaaS company. His expertise will further drive Devoli’s growth and success.

Conclusion

Devoli’s continued growth is a story that’s still being written, and we’re thrilled to support them on this journey. Their success reflects Punakaiki Fund’s unique position in the venture capital landscape:

- Unique Deal Flow: Investing in companies that other VCs don’t.

- Long-Term Commitment: Nurturing companies over time for sustainable growth.

- Diversified Portfolio: Offering stability through established businesses and potential through early-stage startups.

If you’re interested in being part of this exciting journey and supporting New Zealand’s most promising companies, we’d love to hear from you.

Want to Learn More?

Leave your details and one of our team will be in touch to provide further information.