Investing in Punakaiki Fund

We are currently accepting investments from wholesale and eligible investors. Read the Information Memorandum and invest through Catalist.

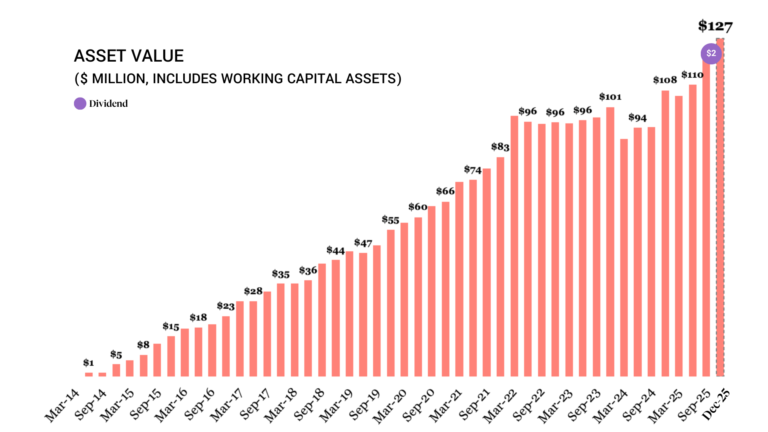

8Fund Size

$127 Million

Portfolio Size

18 Companies

Offer Price

$34.50 per Share

Min. Investment

NZD $50,000

Open to

Wholesale / AIP Visa Investors

Invest in our current wholesale offer

Diversify your portfolio with an investment in some of New Zealand’s most promising high growth tech companies, including: Devoli, Projectworks, Couchdrop, Whip Around and many more.

Our 2025 Wholesale Offer is now live on Catalist.

- Offer price: $34.50 per Share

- Min. Investment: NZD $50,000

Review the Information Memorandum

The Information Memorandum provides a full summary of our current investment offer.

Why Invest?

Unabashedly Boring

Boring is the new exciting.

In a world obsessed with the next big thing, we take pride in being predictably profitable. We steer clear of speculative fads, focusing instead on sustainable, revenue-generating businesses. Our conservative approach might not make headlines, but it minimises risks and aims for modest, steady growth that’s anything but mundane.

Portfolio Powerhouse

A treasure chest of tech triumphs.

Diving into Punakaiki Fund, you’re not gambling on potential; you’re gaining a share in a proven $127+m portfolio of 18 revenue-generating companies. With a decade of diligent investment and development, our portfolio isn’t just growing; it’s flourishing. This is your chance to invest in a legacy of success, rather than the uncertainty of what’s to come.

A Decade of Delivering

Proven performance, not just promises.

Our track record speaks volumes: over a decade of consistent growth, with more than $50 million in proceeds from iconic Kiwi companies including Vend, Timely, Moxion, LineWize and Quantifi Photonics. With nearly all funds raised already realised, Punakaiki Fund isn’t just participating in New Zealand’s tech success stories; we’re helping write them.

Battle-Tested & Bullish

Experience that builds, not just boasts.

With years of navigating New Zealand’s venture landscape, Punakaiki Fund brings a depth of experience that’s rare and invaluable. We’ve learned to lead, not follow, identifying businesses that are truly impactful. Our strategy is simple: invest in proven, revenue-generating companies that are adored by their customers and poised for global dominance, without getting distracted by the noise.

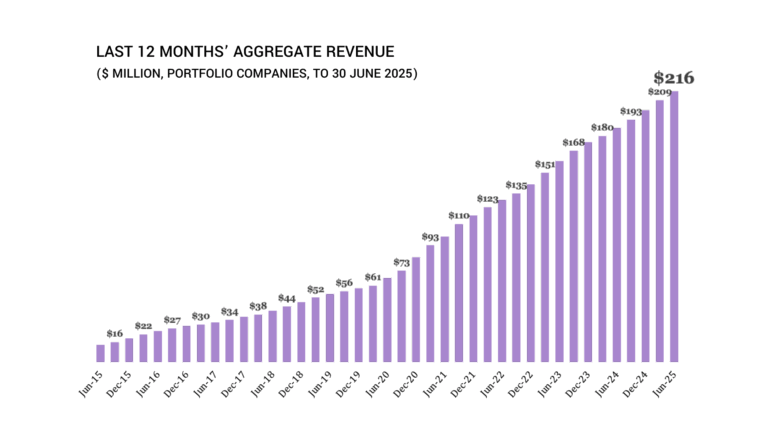

Primed for Growth

Steady growth in turbulent times.

While global markets have faced their share of challenges, Punakaiki Fund’s portfolio stands as a testament to resilience and potential. Our companies have not just weathered the storm; they’ve thrived, with revenues climbing steadily against the odds. This isn’t just growth—it’s a clear indicator of the robust valuations and significant returns on the horizon as markets regain their footing.

Liquidity on the Horizon

A clear path to IPO.

We’re set on an ambitious goal: to list Punakaiki Fund and redefine venture capital liquidity in New Zealand. Designed with this future in mind, our structure promises an innovative route to liquidity, allowing you to enjoy the benefits of your investment on a timeline that traditional VC funds can’t match.

Valuation Virtuosos

Sharp valuations, smarter investments.

Our knack for nailing valuations means we’re ahead of the game. Systematic, market-aligned, and independently audited, we avoid the valuation pitfalls that have tripped up many during the hype highs of recent years. By saying no to overvaluation and capping our expectations, we protect your investment from market mania, ensuring sustainable growth.

Notable Exits

25% IRR

Exited for over $500m

33% IRR

Revenue increased 25x

3,500% IRR

Acquired by AutoDesk

18% IRR

Cyber security for 25,000+ schools

27% IRR

Acquired by Teradyne Inc. (NASDAQ)

25% IRR

Exited for over $500m

33% IRR

Revenue increased 25x

3,500% IRR

Acquired by AutoDesk

18% IRR

Cyber security for 25,000+ schools

About Punakaiki Fund

Punakaiki Fund Limited (PFL) is an actively managed venture capital investment company with total assets of $123.3 million, as at 30 September 2025.

We specialise in long-term investments in privately held, high-growth New Zealand technology companies. We invest in companies that are revenue-generating, possess unique competitive edges, and have the potential to dominate a global niche.

Our Mission:

- Global Success: Drive New Zealand technology companies to worldwide prominence.

- Venture Capital Access: Broaden investor access to the dynamic venture capital sector.

- Predictable Returns: Deliver strong, predictable returns to our investors.

- Economic Transformation: Propel New Zealand’s shift from volume-based to value-based economy.

Evergreen Fund: A Unique Approach

Unlike traditional venture capital funds, Punakaiki Fund is evergreen. This means we don’t operate under the pressure of an exit clock. Instead, we have the flexibility to continuously raise capital, reinvesting returns into our most promising portfolio companies or new, high-potential investments. Our structure allows us to attract high quality founders who seek out our specific expertise and understand the benefits of long-term investment horizons.

We are the only New Zealand venture fund to have invested in some of Aotearoa’s brightest tech companies, including: Projectworks, Couchdrop, Devoli, Whip Around, and more

$50+ million

Proceeds from exits and dividends. Excludes future escrowed payments from exits.

3.6x Uplift

Overall increase in value from the exits of Timely, Vend, Moxion, Linewize, and Quantifi Photonics.

$950+ million

Total combined sale price of notable exits.

""The Punakaiki Fund understand the early stages and what founders need at that stage. They gave us the time to explore and create. It was always about making sure you’re building the company and heading in the right direction"

PAUL ORGAN | ORAH FOUNDER AND CEO

Want to learn more?

Leave your details and one of our team will be in touch to provide further information.

How to Invest

Punakaiki Fund’s offers and share register are administered by Catalist Markets Limited (Catalist).

Investments into Punakaiki Fund can be made via Catalist. Simply follow the onboarding and investment instructions detailed below. Catalist is also responsible for undertaking all regulatory checks on investors prior to an investment being made, including identity and tax checks for AML compliance.

- Log in to your Catalist Account

- Invest via the Punakaiki Fund Offer page on Catalist

- Review the Information Memorandum, decide on your investment amount, and click “Invest now” to proceed.

- Follow the prompts to input a verification code sent to your email, then transfer the investment amount as instructed. Your shareholding details will be confirmed by Catalist.

Don’t have a Catalist account? Sign up via the Punakaiki Fund sign up page.

Prepare your Documents

Note: Catalist can electronically verify your ID and proof of address if this information is held by national database in an Electronic Verification Territory. If Catalist is able to verify your information in this way, you won’t need to provide certified document copies of your ID and proof of address. If Catalist can’t verify your information in this way, you will still be required to provide the certified copies.

You will need the following

- Certified ID: Provide a certified copy of your passport or national ID card. This must include your name, date of birth, photo, and signature.

- Proof of Address: Supply a recent document (no older than 3 months) such as a utility bill or bank statement that shows your name and current address.

- Tax ID Numbers: Share tax identification numbers for all jurisdictions where you’re taxable.

- Create your Catalist Account:

- Sign-Up via the Punakaiki Fund page on Catalist.

- Follow the link sent to your email to verify your account.

- Log in and complete the identity verification steps. If electronic verification isn’t available for your country, you’ll need to manually upload the certified documents from Step 1.

- Wholesale Certification:

- Confirm you’re a wholesale investor according to New Zealand law. This step is crucial before making any investment.

- Confirm you’re a wholesale investor according to New Zealand law. This step is crucial before making any investment.

- Investment:

- After completing your registration and certification, visit the Punakaiki Fund Offer page on Catalist to view the investment opportunity.

- Review the Information Memorandum, decide on your investment amount, and click “Invest now” to proceed.

- Follow the prompts to input a verification code sent to your email, then transfer the investment amount as instructed. Your shareholding details will be confirmed by Catalist.

Prepare your Documents

Note: Catalist can electronically verify your ID and proof of address if this information is held by national database in an Electronic Verification Territory. If Catalist is able to verify your information in this way, you won’t need to provide certified document copies of your ID and proof of address. If Catalist can’t verify your information in this way, you will still be required to provide the certified copies.

You will need the following

- Certified ID: Provide a certified copy of your passport or national ID card. This must include your name, date of birth, photo, and signature.

- Proof of Address: Supply a recent document (no older than 3 months) such as a utility bill or bank statement that shows your name and current address.

- Tax ID Numbers: Share tax identification numbers for all jurisdictions where you’re taxable.

- Create your Catalist Account:

- Sign-Up via the Punakaiki Fund page on Catalist.

- Follow the link sent to your email to verify your account.

- Log in and complete the identity verification steps. If electronic verification isn’t available for your country, you’ll need to manually upload the certified documents from Step 1.

- Wholesale Certification:

- Confirm you’re a wholesale investor according to New Zealand law. This step is crucial before making any investment.

If you are investing jointly (e.g., with your partner), then your co-investor will also need to complete the steps above to set up their own Catalist account using a different email address. Once accounts have been created for all parties, email Catalist, copying your co-investor, and request that the accounts be merged into one joint account. Please also specify which email address you would like to be the primary contact for the account. Catalist will inform you when this has been completed. Both investors will be able to log into the joint account.

- Confirm you’re a wholesale investor according to New Zealand law. This step is crucial before making any investment.

- Investment:

- After completing your registration and certification, visit the Punakaiki Fund Offer page on Catalist to view the investment opportunity.

- Review the Information Memorandum, decide on your investment amount, and click “Invest now” to proceed.

- Follow the prompts to input a verification code sent to your email, then transfer the investment amount as instructed. Your shareholding details will be confirmed by Catalist.

- Sign-Up via the Punakaiki Fund page on Catalist.

- Select “Trust Investor” from the dropdown menu.

- Verify your email and complete the due diligence processes as prompted.

Notes:

- if your trust does not have a) New Zealand bank account, simply input – “00 0000 0000000 00”

- Access Code(s) – AIP Investors should use: “AIPvisa”

- “Key People” – Please add the details for each of the trust’s trustees, large beneficiaries or other people acting on behalf of the trust. You may elect whether you provide the identity, proof of address and tax information about each trustee, or whether Catalist can email each trustee directly for this information;

- For each person, enter the requested information. For the “Identity Type” question, select “I don’t have either” and upload all the applicable documentation, ensuring that the copies are certified where necessary

If you indicate that Catalist should contact the trustees, large beneficiaries or other people acting on behalf of the trust to obtain information directly, then you will be copied in on the email sent to them. We suggest you also contact them directly to ask them to complete the necessary checks. If they live in a territory that supports electronic verification (see below), they can request it and Catalist will send them a link to complete the process.

- Wholesale Certification – After submitting your details, certify as a wholesale investor on Catalist.

- Investment – Invest via Punakaiki Fund Offer page on Catalist. Review the key documents and confirm your investment amount and details.

If you are investing via a financial intermediary, such as a financial advisor or wealth manager, simply direct them to invest in Punakaiki Fund and they will be able to make all of the necessary arrangements using the instructions in the guidance note linked below. Be sure to pass their internal compliance checks before instructing them to invest.

PDF – Punakaiki Fund Investment Process – Financial Intermediaries

The following is a list of territories for which Catalist is able to undertake electronic Anti-money laundering customer due diligence checks (as at 14 September 2023).

- Australia

- Austria

- Brazil

- Canada

- China

- Denmark

- Finland

- France

- Germany

- India

- Italy

- Mexico

- Netherlands

- New Zealand

- Norway

- South Africa

- Spain

- Sweden

- Switzerland

- United Kingdom

- United States of America

The term “wholesale investor” is defined under the Financial Markets Conduct Act of 2013 as an individual or entity (such as a company, trust, or partnership) authorised to participate in investment opportunities that are generally not accessible to the general public or retail investors. These opportunities often include early-stage companies and venture capital investments, which are considered higher risk and typically lack the extensive information or protective measures provided to retail investors for their safeguarding.

To be classified as a wholesale investor, one must meet specific criteria or fall within certain categories. Our investors usually fit into one or more of four primary qualifications, which can be summarised into two main groups:

- Those possessing the necessary experience to comprehend and willingly take on the risks associated with their investments.

- Those with adequate financial resources to seek professional advice if needed or to absorb potential financial losses.

The four main qualifications that our investors often rely on include:

Qualifying as a “Large Investor” by owning net assets or reporting a consolidated turnover of at least $5 million over the previous two fiscal years.

Being an “Investment Business,” meaning the investor’s main operation involves investing in financial products (like fund management), offering financial advice, or trading in financial products on behalf of others (e.g., brokers or wealth managers).

Satisfying the “Investment Activity” criteria, which applies to individuals who either own or have owned a portfolio of specific financial products (such as shares, bonds, derivatives, etc.) worth over $1 million in the last two years, or have been actively involved in the investment decisions of an investment business for a minimum of two years within the last decade.

Recognized as an “Eligible Investor” by having relevant prior experience in investing in financial products that enables them to evaluate the merits and necessary information for making informed decisions. This includes providing a declaration of understanding the implications of being deemed an eligible investor, which must be verified by a professional such as a lawyer, accountant, or financial advisor.

This explanation is provided in simple terms and should not be taken as advice on whether you qualify as a wholesale investor. If you are uncertain about your eligibility, it is advisable to consult with a professional advisor, such as an accountant or financial advisor.

- All investors must certify as wholesale under New Zealand regulations.

- Direct company investments are not permitted under AIP Visa rules. However, trusts, where you are a trustee and beneficiary, can invest.

- Registering with Catalist does not obligate you to invest but prepares you for when you’re ready.

Catalist has a variety of resources on its website to assist investors with the Catalist Application Process, including:

- Frequently Asked Questions page

- How to navigate around your Catalist account

- How to submit a bid or offer

- An explanation of the live orderbook

If you have any questions regarding the Catalist platform or the applications processes, please contact Catalist in the first instance:

020 4009 6929 | hello@catalist.co.nz

If you would like to talk to Punakaiki Fund about the application process or any aspect of the investment process, please contact info@punakaikifund.co.nz

Want to Learn More?

Leave your details and one of our team will be in touch to provide further information.