Another quarter has raced past and we’re thrilled to see our companies defying economic headwinds to report strong growth in revenues.

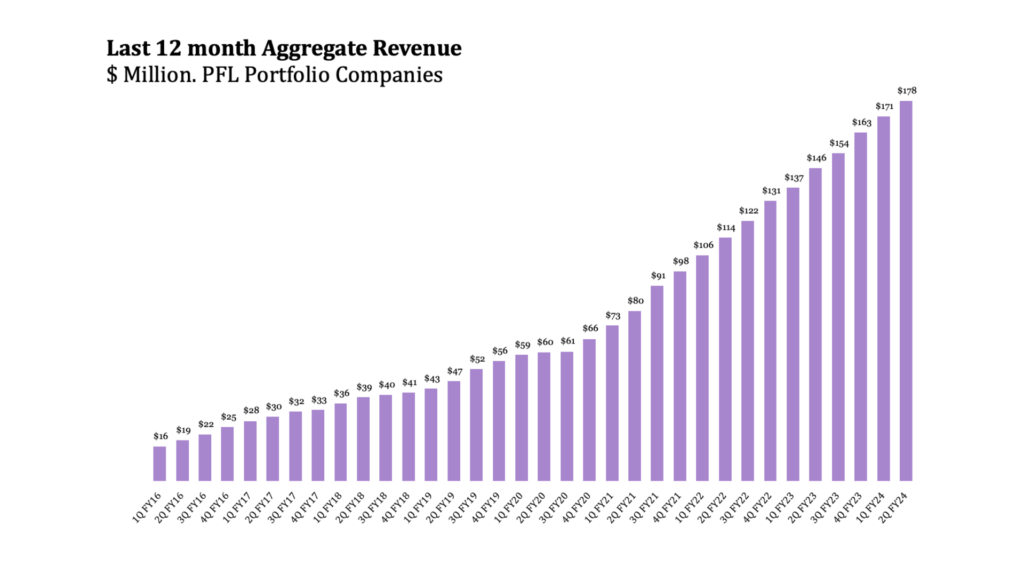

As the tide went out with capital markets over the last two years it became clearer that most of Punakaiki Fund’s companies were in unusually good positions, as were many other local companies. Those companies delivered last-twelve-months’ revenue of $177 million, with the top 10 companies representing $163 million of that. The growth rate, weighted by valuation, was 31%, down from over 40% last quarter. That quarterly fall was primarily driven by the lumpy timing of revenue from two companies, albeit with flat performance from one of them.

All of Punakaiki Fund’s top ten companies operate within themselves, either continuing to operate without fundraising, with a path to cash flow breakeven, with no or relatively small amounts of funding required. We would like to invest more in some of the top performing companies and will seek to do so when we have the funds.

Internationally, especially in Silicon Valley, there is a shift in thinking to focus on the cash flow sustainability of companies rather than over-funded hyper-growth. It’s nice for the world to catch up with Punakaiki Fund’s investment philosophy, which we see has resulted in much lower failure rates, larger but more slowly delivered gains in valuation, and more credibility in the valuation of our investments. We see that New Zealand companies are far more likely to be sustainable in the first place as the absence of a feeding frenzy of venture capital investors at every stage means that companies need to plan for no future raises.

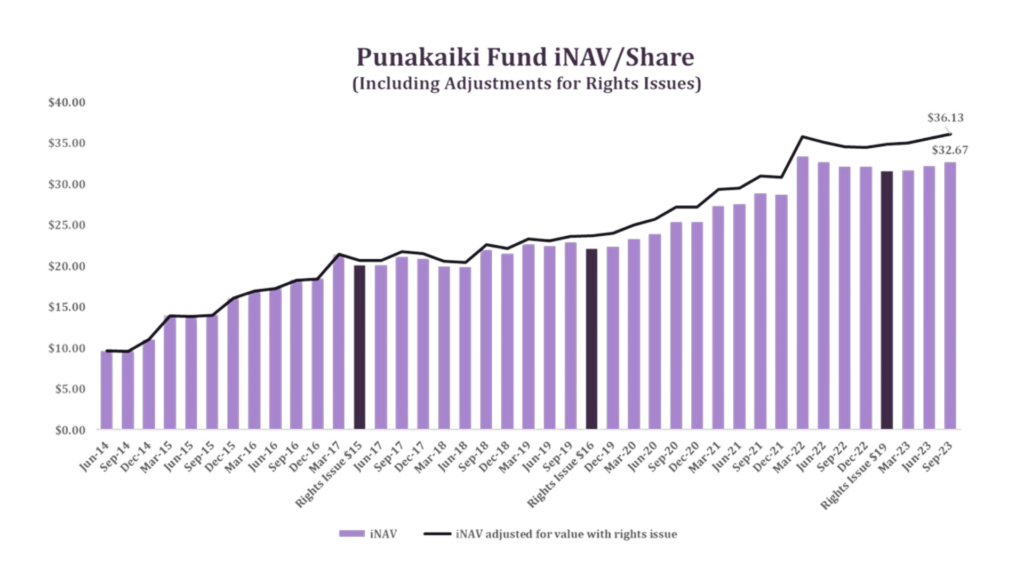

How did this affect our valuation? Assets increased slightly in value this quarter, rising to $97.5 from $96.9 million as at 30 September 2023. This is a good result in the context of international peer funds falling around 14% year-on-year, continued high inflation and economic headwinds internationally.

Quarterly highlights include:

To participate in the wholesale offer, visit Catalist to login or register to trade.

Click here to read the full report for the quarter to 30 September 2023.

We also spoke with Dr Stephen Pool, Founder and CEO of Core Schedule. Read the full interview here.