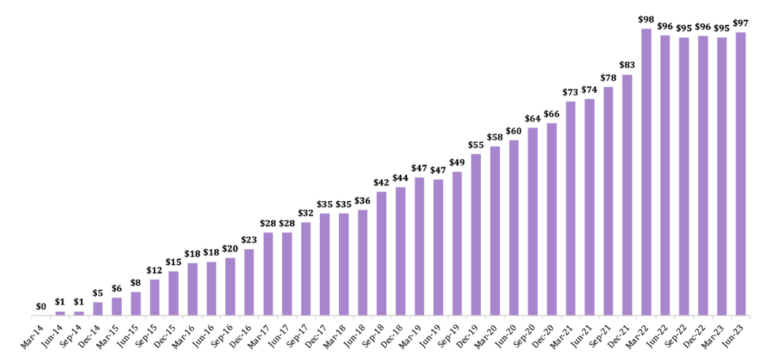

Punakaiki Fund’s report for the quarter to 30 June 2023 showed an uptick in valuations as our companies emerged out of post-Covid gloom.

Here are some of the highlights from the report:

Of course, success is not true for every company (as we saw with Melon Health being placed into receivership earlier this year). It’s natural for companies to experience periods of stagnated revenue, and while we proactively account for such periods with corresponding markdowns of those companies’ valuations in our portfolio, our long-term buy-and-hold strategy remains largely unaffected.

Pleasingly, Punakaiki Fund was approved as an ‘Acceptable Managed Fund’ for the New Zealand Government’s Active Investor Plus Visa. This is a fantastic opportunity to amplify our reach. See our story about it here.

Shareholders can read the quarterly report here.