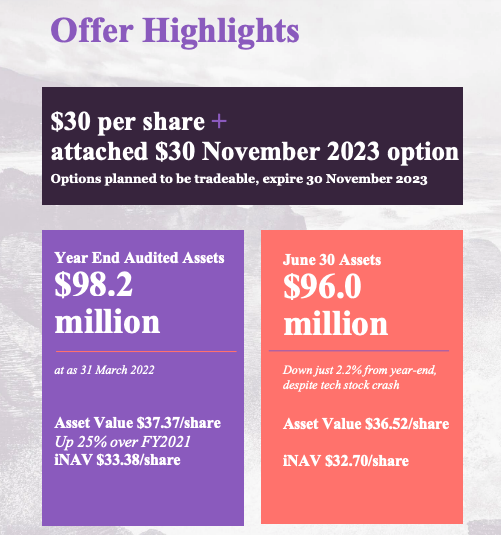

We’re proud to invite wholesale investors to invest in Punakaiki Fund through this year’s Wholesale Offer – including Options. We can think of 98.2 million reasons why you should invest, but to keep it simple we’ve boiled it down to five compelling points.

1: As a hedge against the markets

With share markets, housing markets, debt markets and, now, currency markets in turmoil there are very few places to place money.

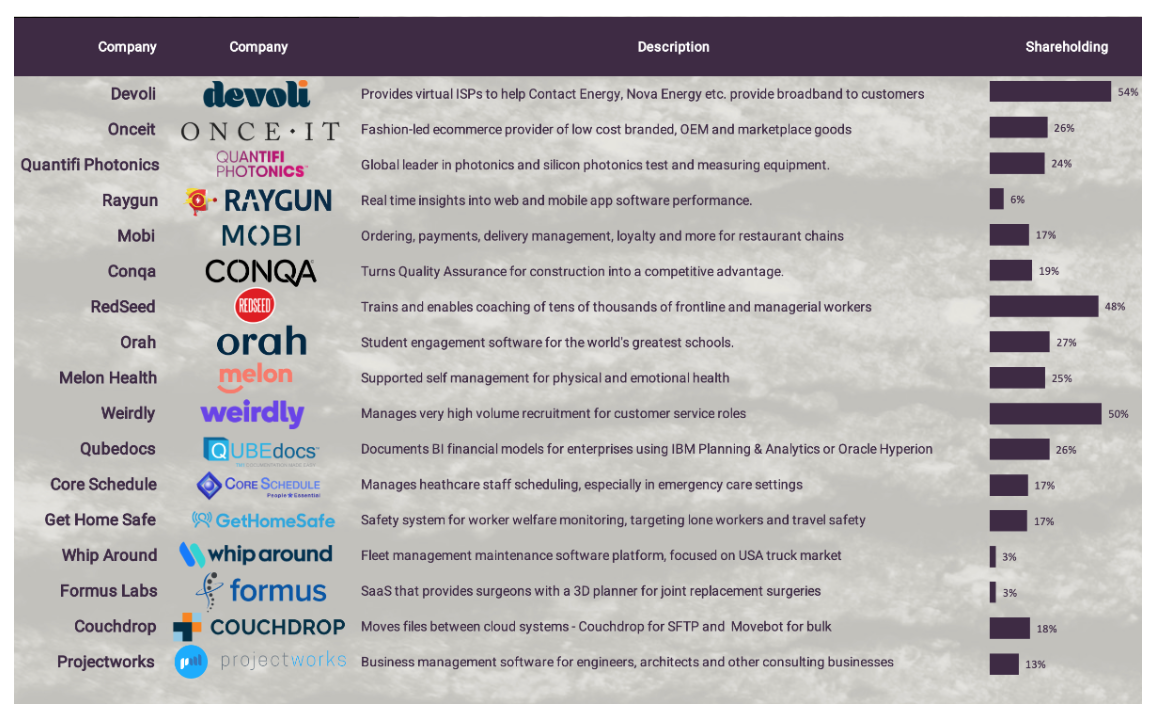

Punakaiki Fund is underpinned by a portfolio that is diversified across currencies, industries and business models, and which has weathered the toughest storms, as we saw with the first year of the COVID-19 pandemic.

Our carefully conservative valuations remain valid (we’ve informally checked), and the underlying growth from portfolio companies, shown below, continues. In the long run that growth will overwhelm shorter term market movements, and that will flow through to value for all. Along with the stability is, unusually, the ability for certain companies within the portfolio to show dramatically rapid positive valuation changes, as is typical with venture capital.

2: Funding goes to the companies

We have now raised enough to cover our estimated operating costs for the next twelve months, so essentially all additional funds will be placed with hi-tech companies.

3: Accelerate the progress of existing investments

While we could easily place $20-50 million with current investments, we have immediate plans to place $2 million with three companies – including Conqa, where we will join a convertible note fund raising round. We are very excited about the three companies and their progress, and want to be able to help them accelerate their growth, and look to more substantial rounds in 2023.

4: Big changes are coming

With our new CFO, Ben Kay, starting in November, we will be increasingly targeting larger investors, and focusing on our path to IPO. We are unclear on what that means in practise, and we will be listening to investor needs as we think about the steps over the next few months. That may mean we might not be back with a smaller offer for investors for a while.

5: The Options have value

While the price per share, at $30, is well beneath the investor net asset value per share, the attached option to buy another $30 share might become very valuable. Our track record is one of a rising price per share, and even with discounts that $30 option would be valuable if that trend continues. We will facilitate trading in those options, so even if the cash is not there next year, investors have a chance of getting some return.

Are you eligible to invest?

The offer is open to “Wholesale Investors”, and there are a number of ways to qualify. If in doubt please contact Catalist or ourselves.

We’ve had a number of investors ask whether or not they are able to invest in either the Punakaiki Fund Wholesale Offer or the Climate Venture Capital Fund offer.

We have worked with Catalist and they are now automatically approving as “wholesale” investors those of you who have invested into past Punakaiki Fund wholesale offers under the Clause 3 of Schedule 1 of the Financial Market Conduct Act.

Unfortunately this excludes investors who were part of the very first offer in April 2014, as the wholesale certification was done under different legislation. It also excludes investors who were “close business associates”.

Read the Information Memorandum for details of the offer, and invest through the Punakaiki Fund page on the Catalist platform.